An AI scheduling assistant that lives up to the hype.

Skej is an AI scheduling assistant that works just like a human. You can CC Skej on any email, and watch it book all your meetings. Skej handles scheduling, rescheduling, and event reminders. Imagine life with a 24/7 assistant who responds so naturally, you’ll forget it’s AI.

FUTURE

Why AI Could Cause an Economic Crisis

Everyone seems to agree about AI’s huge positive impact on the economy. But, as more people look into this question, the reality becomes grimmer.

In fact, AI could send the global economy into a terrific economic crisis.

But how is that possible? How could the all-problem-solving technology, humanity’s “greatest achievement,” actually backfire? The main reason is that, ironically, AI might have appeared at the worst time possible.

In an industry not short of insufferable hype, today we take a look at AI’s dark side. Or, as I call it, the consequences of running too damn fast.

Let’s dive in.

AI is a GPT. But a different one?

The general assumption, to which I assume both of us agree, is that Artificial Intelligence is going to be a profoundly transformative technology, one that will literally turn the world upside down (hopefully for the better).

Goldman Sachs Research (2023) projects that the diffusion of generative AI tools could “drive a 7 percent, almost $7 trillion, increase in global GDP and lift productivity growth by 1.5 percentage points a year over the next decade.”

The McKinsey Global Institute (2023) estimates that generative AI could unlock $2.6–$4.4 trillion in value annually and, when combined with broader work-automation technologies, raise labor productivity growth by 0.5 to 3.4 percentage points each year.

A Federal Reserve Bank of Dallas analysis (2025) notes economists at Goldman Sachs expect AI adoption to boost U.S. productivity growth by 0.3 – 3.0 percentage points a year for a decade, with a median scenario of 1.5 points, implying a sizeable lift to living standards if realised.

JP Morgan Private Bank (2024) argues AI’s diffusion could show up in macro data within about seven years, far faster than past GPTs, and models a 17.5 percent upside to long-run productivity relative to a no-AI baseline, eclipsing the personal-computer era.

Although we also have a fair share of skepticism, even coming from Nobel laureates, the general sentiment is highly positive.

And the reason is that there is global consensus that AI is one of the considered ‘GPTs’, or general-purpose technologies.

But what are these, and why does it matter so much?

Trip down memory lane

Economic historians classify GPTs as technological inventions that become ubiquitous across industries, spawn complementary innovations, and ultimately reshape aggregate productivity.

The canonical list (steam power, electricity, and the Internet) all showed a broadly similar pattern of invention, slow diffusion, followed by economy-wide takeoff, but with markedly different timetables and magnitudes.

Just to give a handful of examples:

While James Watt’s improved design was patented in 1769, steam horsepower remained a niche until about 1830.

The first power station was built in 1882, but it wasn’t until four decades later that electricity became the dominant form of horsepower.

Thirty years was also what it took for personal computers to become mainstream (After the invention of the microchip in 2971, only 20 million PCs were sold worldwide by 1990).

Simply put, some technologies are transformative, but they take decades to make a significant impact on our lives.

This gradual insertion of the technology into society prevented these disruptions from causing excessive pain during the transition, as young people had time to reskill for new jobs emerging from the GPT, while the elderly transitioned into retirement without losing their jobs before they were laid off.

But there are reasons to believe AI, another undeniable GPT, won’t make things that easy.

“Gradually, then suddenly.”

One of my favorite quotes ever comes from the great Ernest Hemingway. In his famous book The Sun Also Rises, a character explains his bankruptcy happened “two ways: gradually, then suddenly,” which is exactly how I believe AI’s impact will be felt.

There are multiple reasons to believe that AI’s diffusion will see a massive take-off that could cause many to be in great pain.

Probably the biggest reason is that the speed of progress in AI is so rapid that AI itself obsoletes the state-of-the-art in weeks or sometimes days, leading to consistent pressure to drop prices. This, combined with the Internet’s distribution capabilities, makes AI diffusion much faster.

Although clearly singing from his own Hymn book, Dario Amodei, Anthropic’s co-founder and CEO, predicted that AI could represent a “white-collar bloodbath”, erasing 10 to 20% of jobs in the upcoming five years.

For reference, such a rapid unemployment peak represents the low and high points of the Great Depression that followed the infamous 1929 crash.

Even if Dario is exaggerating, any scenario that comes remotely close to that would have dire consequences in our current global state of affairs.

But why? Simple, governments aren’t even remotely close to being prepared for that scenario.

AI & Its Biggest Enemy: Debt.

It’s becoming really hard to deny that the global economy is in one huge debt bubble.

The Elephant in the Room: Debt.

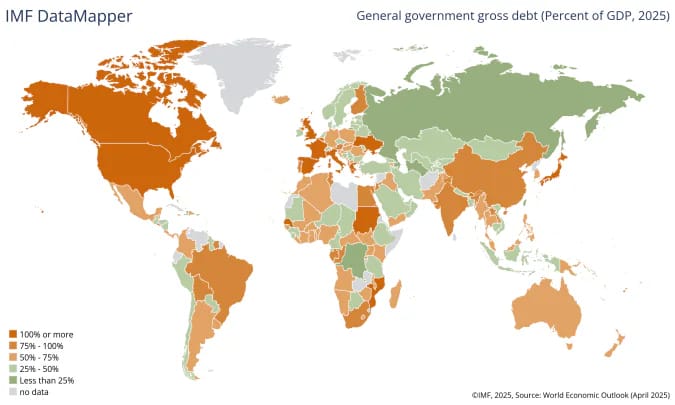

Except for some minor exceptions like the Nordic countries and a handful of others, most large economies have public debt that exceeds their current GDP, or are inching towards it.

Just to give a reference of the scariness of the situation:

The US will spend in 2025 more money servicing its debt (paying the interest on government-issued bonds) than on defense, reaching close to a trillion dollars just on interest payments.

One in every four euros in an average Spanish pension is financed through public debt, with the Spanish social security having an astronomical 27% yearly deficit, or $63 billion.

European countries are becoming tax hellholes, as salaries have remained under weak growth over the last 30 years (2% in countries like Spain or Italy), while taxes have outgrown the growth of everything else.

But how have we reached this point?

Government spending grew steadily since the 2008 crisis, but it skyrocketed during and after the COVID pandemic.

For instance, if the US Government were to revert to 2019 spending levels, at current income values, it would have a fiscal surplus. Instead, it’s not only already in a large deficit but is also projected to increase by at least $4 trillion, or 22% of current GDP, over the next decade, thanks to the “Big Beautiful Bill”.

While countries like France have announced measures, the majority of these economies are actually increasing their debt instead of seeking ways to decrease it.

As expected, many, including Elon Musk, are looking to AI as a solution to the problem, despite his failed attempt at curbing public spending with DOGE.

But is it, though? You may not like my answer.

The tricky nature of AI & its impact on GDP

When selling AI’s benefits to humanity, besides pipedreams of drug discovery, gene editing, and other dreams that may not become reality, most people mention the idea of increased productivity: with AI, you can do more with less.

At first, this feels impossible to deny.

Just go to your ChatGPT account, and you can ask it to generate day-long reports in minutes, amazing visual creations in seconds, or entire business applications with tools like Replit Agent.

Granola and Microsoft Teams generate instant meeting reports

LLMs can instantly read your Outlook account and generate daily reports, as we demonstrated in our recent post.

And the list goes on. Automatically, people assume that this would mean an automatic explosion in economic growth.

But is it? Quite possibly over the long run, but I don’t think we have put nearly the required effort into understanding AI’s effect in the short term.

If we think about what 'output’ is, how GDP is measured, it is through the straightforward formula price times quantity. Every unit of product or service sold times its price added together gives you the total output of any given country or the global economy.

Usually, when one grows, the other falls. If I can produce ten times more of a product or service for the same effort, unless you’re a monopoly, competition will likely force you to drop prices.

Therefore, for output to grow, productivity must increase more than the price decrease.

Otherwise, nominal GDP actually falls even though the real output has grown (we have more of that stuff). This is called “good deflation”.

As we’ll see in a minute, this could actually be disastrous in the short term.

GDPs also behave in unexpected ways. Particularly, we need to acknowledge the existence of the Baumol effect, also known as the cost disease. In very simple terms, the Baumol effect is the reason why high-productivity sectors are “squeezed out” of the GDP picture of any given country for three reasons:

Productivity increases so much that prices collapse, leading to an inevitable decrease in total output for that sector

Output crashes even more as we hit peak demand (there isn’t enough demand to increase total output).

The third point, the actual Baumol effect, is related to costs. As productivity rises in those sectors, so do wages. Thus, to remain competitive and continue to attract human capital, low-productivity sectors increase costs (i.e., wage rises) to retain or attract human capital.

All three lead to a low-productivity spiral, as productivity not only does not increase but worsens as costs rise, leading to even lower productivity, which is why most GDPs are dominated by low-productivity sectors like healthcare and education.

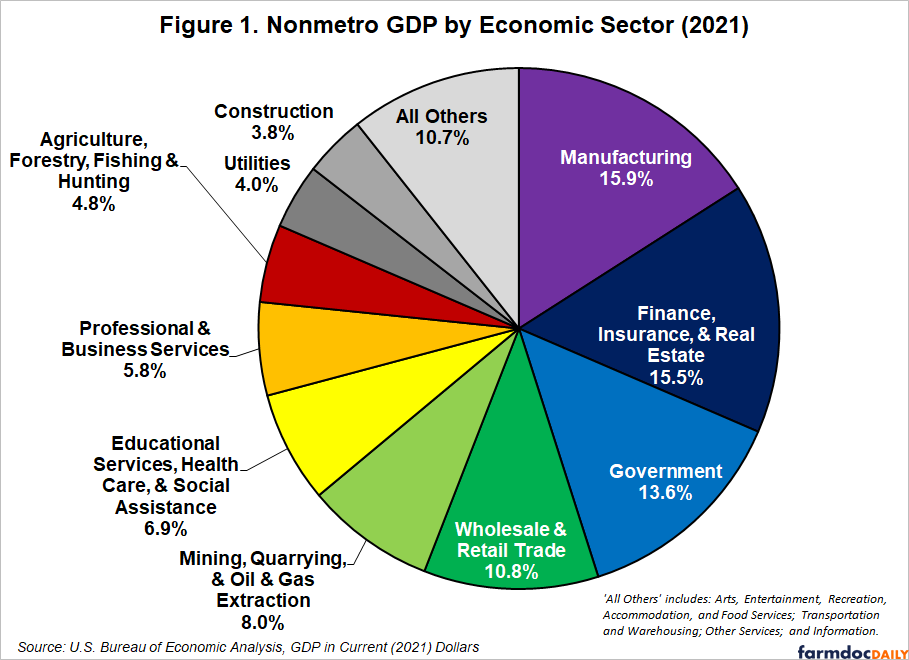

A perfect example of this is agriculture, the dominant sector one hundred years ago that, today, represents low single-digit values in most developed economies as huge productivity improvements have squeezed it out as a percentage of global country output.

So, to summarize:

Not only can high productivity shocks (that AI is assumed to cause) lead to the overall nominal GDP falling,

But an asymmetrical potential impact of AI across sectors, if it doesn’t impact low-productivity sectors equally or more than the rest, would not only not cure the cost disease problem as some predict AI will, but it could only exacerbate it, leading to the scenario that Acemoglu outlined where AI’s effect on GDPs would actually be modest.

Luckily, we have already discussed multiple times how AI’s potential is huge in low-productive sectors like healthcare or education, so I personally disagree with Acemoglu’s take and believe AI’s impact will be massive.

In this defense, he made those remarks way before all the huge progress we have seen over the past year.

But why would a GDP fall be so concerning if it’s good deflation (lower prices of everything, reasonable for consumers)?

Well, ironically, far from making things better, AI might send us into a severe global recession.

Hold on. How can a technology poised to create so much value, potentially even curing all diseases, discovering new sciences, or automating all jobs away cause a global recession?

And the short answer is timing, which couldn’t be worse.

Subscribe to Full Premium package to read the rest.

Become a paying subscriber of Full Premium package to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- NO ADS

- An additional insights email on Tuesdays

- Gain access to TheWhiteBox's knowledge base to access four times more content than the free version on markets, cutting-edge research, company deep dives, AI engineering tips, & more