FUTURE

Is AI in a Huge Bubble?

The topic as to whether AI is in a bubble has no in-between. Either, ‘Yes, it's the biggest bubble ever,’ or ‘No, we are just getting started, this is the best transformational technology in history!’

But as always, the answer is far more nuanced.

Today, we will cover the following topics: Private and public valuations, with some insane numbers like double-digit billion-dollar pre-revenue valuations and a company with a PE of 600 plus, historical patterns (CAPE, comparison to “dot-com” bubble), debt securitization and other financing trends, a concerning trend coming from SV, up-to-date adoption data, a real capex-to-revenue gap exercise you won’t find elsewhere, the $1 trillion dollar bet, and energy constraints, among other data-driven insights, all in one single piece for you to enjoy.

Let’s dive in.

A Story About AI Markets

Before we get into public and private AI investing, for the sake of the piece, let’s first provide a quick definition of a bubble.

According to the International Monetary Fund, a bubble occurs when public and private valuations are based on unsustainable investor behavior instead of fundamentals.

In other words, when the valuations of the companies inside the bubble are based on things like hype, FOMO (Fear of Missing Out), and, importantly, solely on the idea that the company will be worth more in the future, not because it has a strong business or a clear path to monetization, but just because the underlying technology warrants it.

In other words, 'I don’t know if people actually want what this company is building, but it’s an AI company, so it’s valuable.’

Here, the IMF points at investors as the creators of the bubble, so let’s see what investors are doing. Let’s start with the hottest place of them all: private markets.

Private Markets

Back in March, we saw the biggest private round in finance history, when OpenAI closed a $40 billion investment round ($300 billion valuation) led by companies like SoftBank or Thrive Capital. For reference, that round is almost as large as the entire market capitalization of the Ford Company.

$40 billion for a company that, according to its own estimates, won’t be profitable anytime soon, not before 2029, and lost $5 billion just in 2024.

It must be said that OpenAI is ‘res singularis’; it has strong revenue growth, extreme word of mouth, and hundreds of millions of daily active users.

If you’re an investor and you’re going to bet on someone, it’s them.

In fact, its valuation looks quite healthy for a private company. The current run rate, estimated at $13 billion, puts them at a price-to-sales (PS) ratio (the multiple difference between the company’s valuation and its sales) of 30 or less, not shy from NVIDIA’s current price-to-sales.

Metrics like price-to-sales or price-to-earnings (profits) are heavily used by investors to analyze whether a company is expensive or cheap.

But if you still think it’s excessive, well, you’re in for a wild journey today, my dear reader. If we look at OpenAI's immediate competitors (spare Deepmind, as it belongs to Google), valuation multiples only get worse.

Anthropic was sitting on a $1.4-ish billion runrate by March and a valuation of $61.5 billion, giving a P/S ratio of 44.

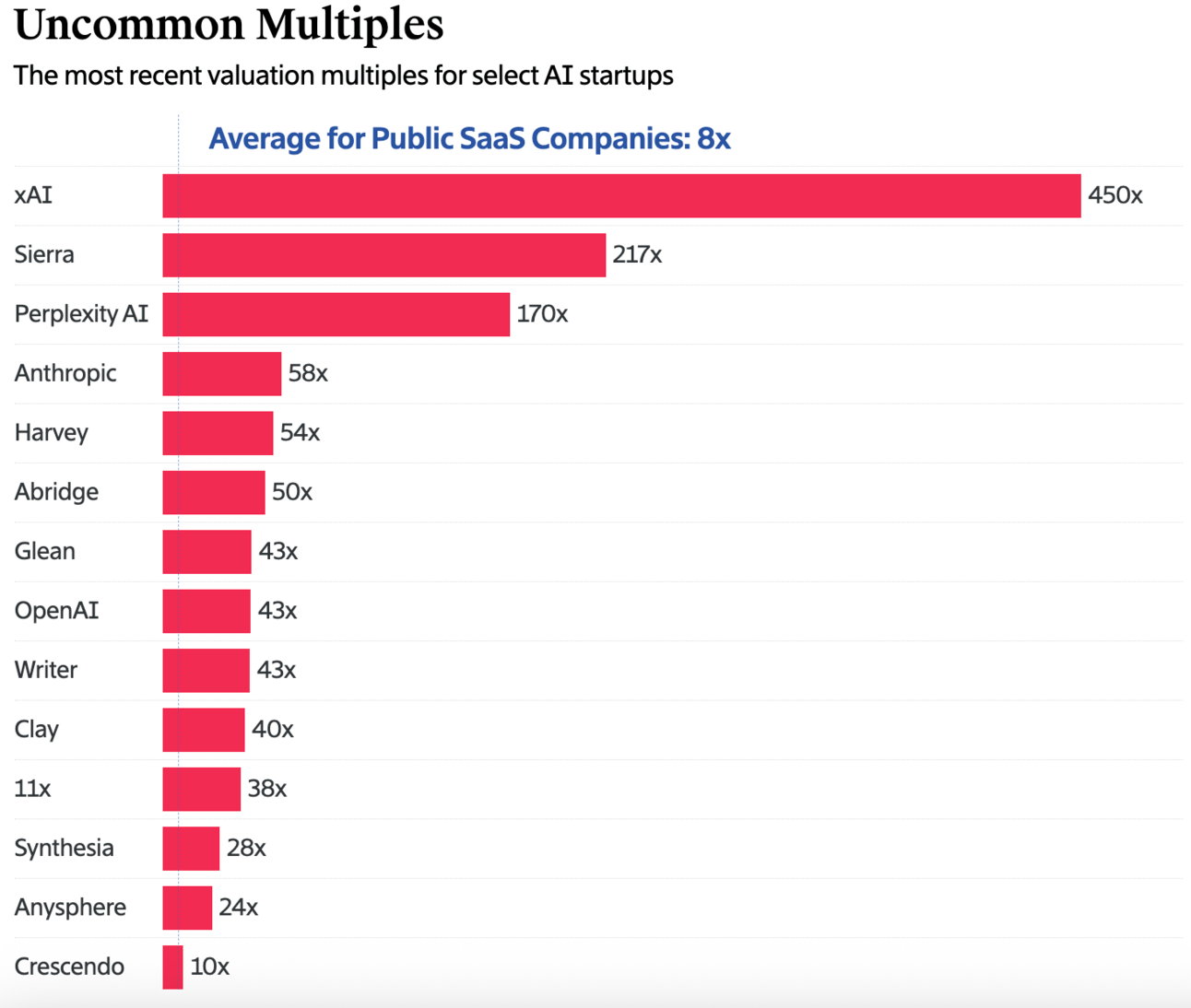

xAI, Elon Musk’s AI company, is a special case because it obviously has the Elon premium. Despite most likely much smaller revenues than Anthropic (not disclosed, but there’s no reason to believe otherwise), it already has a potential upcoming valuation of, brace yourself, $120 billion (although that also factors X). Even if we assume Anthropic’s run rate, it’s still a 120 PS valuation, and The Information estimates that the value is actually closer to 450x.

Perplexity, which just closed a $500 million round at $14 billion, is estimated to have a $100 million run rate, making its valuation a 140x PS multiple.

And you know what’s worse?

Although the numbers aren’t public, it’s estimated that companies like HuggingFace, Cohere, or Sierra have multiples well above 150x or even 200 (the latter is estimated to have a 217x multiple).

Some recent PS multiples, according to The Information. Some points are already outdated. Source

But how high is this? Well, ‘mucho.’

If you’re not that much into valuations, here are some references: The average public SaaS company has a PS ratio of 8, and in cases like steel companies, the multiple is actually below 1, meaning that the company’s market value is lower than its yearly revenues.

Nonetheless, the sectors with the highest PS ratios are semiconductors and software, both highly linked to AI, with multiples of 14 and 11, respectively. Yet, the average PS multiple is much, much smaller than what we are seeing with AI.

Yes, private valuations are murky and are naturally higher than public valuations, but the question is: will AI companies grow their revenues into those multiples? We’ll explore this later.

But before we move into public, two companies and a specific sector must be addressed.

Most—if not all—of the companies I’ve mentioned have at least $50 million in ARR (Annual Recurrent Revenue, or run rate, because most of these companies earn their bucks via subscriptions, so both metrics are mostly equal).

That doesn’t mean they aren’t possibly highly overvalued, but they have revenues nonetheless. But what about the valuations of pre-revenue AI companies?

Here, we have two interesting cases:

Thinking Machines, with an upcoming $9 billion valuation

SafeSuperIntelligence Inc., or SSI, with a, get this, $32 billion valuation

As mentioned, none of these companies have a product, or even a product roadmap. Instead, they have two things:

Star power. The former is founded by several OpenAI co-founders and Mira Murati, OpenAI’s ex-CTO. Moreover, they have onboarded dozens of other OpenAI researchers. The latter is founded by Ilya Sutskever, another OpenAI co-founder and ex-Chief Scientist, and quite possibly a top-3 most respected AI researcher on the planet right now.

A website. Yes, that’s all they have.

Particularly daunting is SSI’s case because its mission is bolder than that of the average AI company, and that’s saying something. In its case, it wants to create not AGI, as OpenAI wants, but superintelligence, or ASI, AIs that are superhuman in every aspect of their existence.

We aren’t even close to AGI, and these guys are building the next thing, which suggests that they won’t have a product anytime soon despite having a valuation larger than Sudan’s GDP.

If we’re looking for bubbly signals, these two take the trophy. Finally, it’s worth mentioning the particular case of AI robotics startups, which have also seen huge valuations despite no tangible revenues at all.

Here, we must highlight FigureAI, which is allegedly raising at a staggering $39 billion valuation, again with close to no revenues.

That said, unlike Thinking Machines and SSI, which are competing in a market that has proven value, Generative AI models, robotics is more of a moonshot, blind faith than in a handful of years, each one of us will have their particular humanoid doing chores at home.

But will they, though? For the moment, they dance.

And what about public markets?

Public Markets

In public markets, AI has played a paramount role in lifting investors' spirits, as AI-related stocks have seen trillions in market gains since ChatGPT was released in November 2022.

Of course, the AI fever is being led by the Hyperscalers (+ Oracle), who will invest ~$343 billion in AI in 2025, from Amazon’s $100 billion to Oracle’s $16 billion. That value, larger than the GDPs of Portugal or Finland, is in itself a great representation of the importance of AI to public markets today.

However, the relationship between public investors and AI is complicated. While they have been encouraging companies to invest in AI, they have grown concerned about whether those investments will ever translate into actual revenues.

Although we will examine AI adoption much more closely later, implementing AI is challenging for clients. This has, in turn, implied that public investors are very reactive to news related to AI companies, which has translated into huge volatility of the implied stocks.

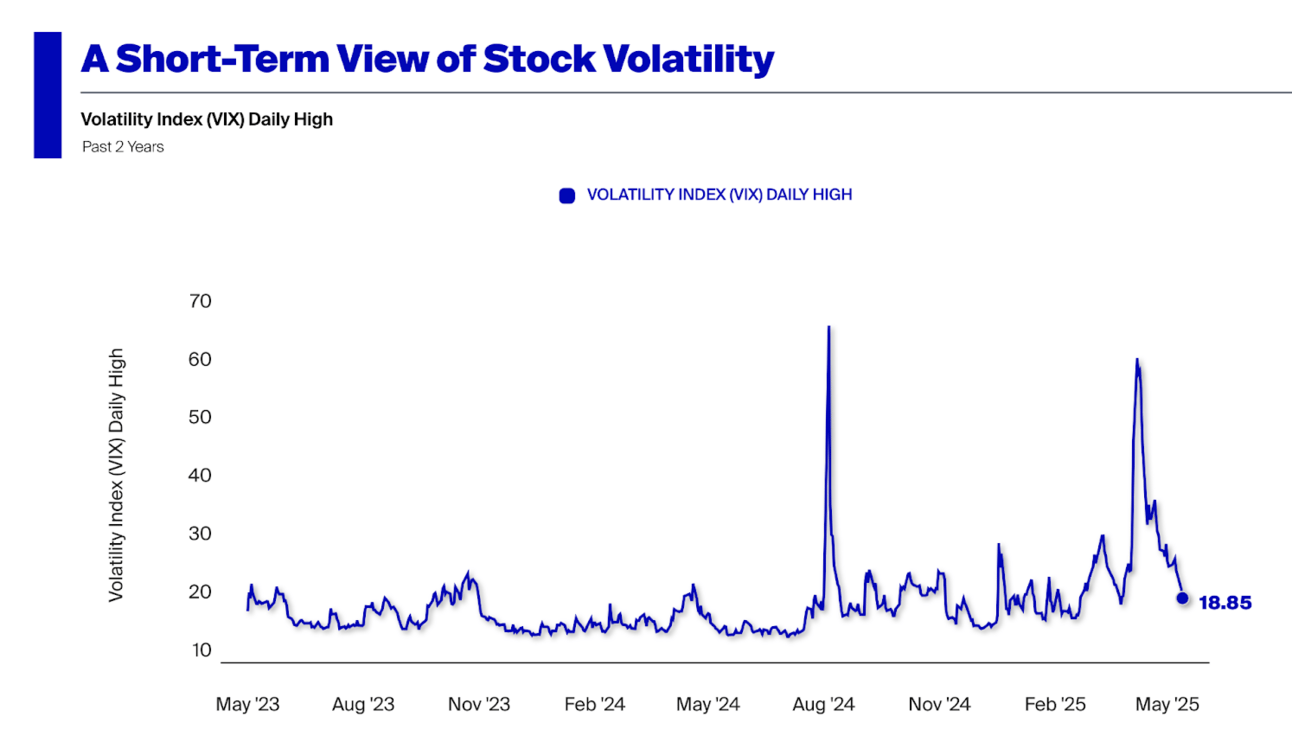

While the VIX, the index that tracks overall market volatility, has nosedived since it skyrocketed with Liberation Day tariffs, AI-specific stocks still see huge price swings based on news about them.

One great example is Coreweave. The data center company, which makes its buck by managing GPU data centers for Hyperscalers or startups like OpenAI, has seen violent price swings almost daily since its IPO in March.

For reference, the stock has more than doubled in less than a month, but intra-day double-digit growth or declines have been common.

For instance:

The stock plunged 13% after they announced an expansion of capital expenditures…

only to recover by increasing its value by 26% in the same day after a new contract with OpenAI was announced, closing the week 60% above the previous price.

Despite it being a solid company, the huge associated risk (it’s nowhere near profitability) has caused it to behave almost like a meme stock, with strong fluctuations every time certain news drops.

But not even the largest AI companies, the Hyperscalers, are exempt from this volatility. NVIDIA has an implied volatility of 51%, indicating the market expects the stock could move up or down by about 51% annualized, which translates to about ±14% over a month, which is abnormal for a company above $3.3 trillion in value.

But if we are discussing potential AI bubbly indicators in public markets, we need to talk about Palantir, an AI company that builds bespoke software for clients and has an intelligence AI platform used by several government agencies.

The 31st largest company in the world by market cap, with a market cap above $300 billion, the stock has a Price-to-earnings ratio of 643 at the time of writing. In layman’s terms, the company’s market value is 643 times larger than its profits, with a PS ratio of 106.

Despite these two being private companies, this PS ratio makes them look four times more expensive than OpenAI and almost twice more expensive than Anthropic. And the PS ratio is 20 times larger than the average of its sector.

But public and private valuations aside, which more or less paint a scary picture, can we look for more signals of bubbly behavior?

Oh boy, we can. And importantly, we can tackle the big question: Is the current state of markets similar or worse to what we saw in the last big technology-driven bubble, the infamous “dot-com” bubble?

Subscribe to Full Premium package to read the rest.

Become a paying subscriber of Full Premium package to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- NO ADS

- An additional insights email on Tuesdays

- Gain access to TheWhiteBox's knowledge base to access four times more content than the free version on markets, cutting-edge research, company deep dives, AI engineering tips, & more