You’ve heard the hype. It’s time for results.

After two years of siloed experiments, proofs of concept that fail to scale, and disappointing ROI, most enterprises are stuck. AI isn't transforming their organizations — it’s adding complexity, friction, and frustration.

But Writer customers are seeing positive impact across their companies. Our end-to-end approach is delivering adoption and ROI at scale. Now, we’re applying that same platform and technology to build agentic AI that actually works for every enterprise.

This isn’t just another hype train that overpromises and underdelivers. It’s the AI you’ve been waiting for — and it’s going to change the way enterprises operate. Be among the first to see end-to-end agentic AI in action. Join us for a live product release on April 10 at 2pm ET (11am PT).

Can't make it live? No worries — register anyway and we'll send you the recording!

FUTURE

The New Tariff Regime and Its Implications for the AI Industry

Tariffs are unequivocally the word of the week, probably of the year. The markets have had the worst two-day streak since 1945, and both days are in the 99.9% percentile of worst trading days since, brace yourself, 1929.

$6.4 trillion, the combined valuations of Apple, Microsoft, and Berkshire Hathaway were wiped out in just two days. And this could just be the beginning. But this is an AI newsletter, so what are the repercussions on AI in general?

Today, you’ll learn the following:

Cover the state of tariffs in a digestible fashion, which is challenging in today’s world

We’ll analyze the direct impact on AI, breaking down the industry to its core: semiconductor supply chain, important countries, and company players at every layer in the AI supply chain, and the most likely impact on balance sheets of the most important companies.

And we’ll lay out the arguments around AI’s crucial strategic value for the West and, in particular, to the future of the US hegemony, which will help you understand the Trump Administration’s strategy; the why, the how, and the when.

Let’s dive in.

A Trip Down Memory Lane

If we want to understand where we are on tariffs, we need to know where we are coming from.

Section 301

Initially, tariffs were almost exclusively targeted at China. In 2018, the first Trump administration launched tariffs on $370B worth of Chinese goods in retaliation for what the US deemed unfair trade practices and intellectual property theft.

These tariffs applied broadly across industries and led to some diversification of supply chains ("China +1" strategies).

Far from reversing his predecessor's actions, the Biden administration doubled down. It kept most tariffs in place, initiating a review process rather than rolling them back.

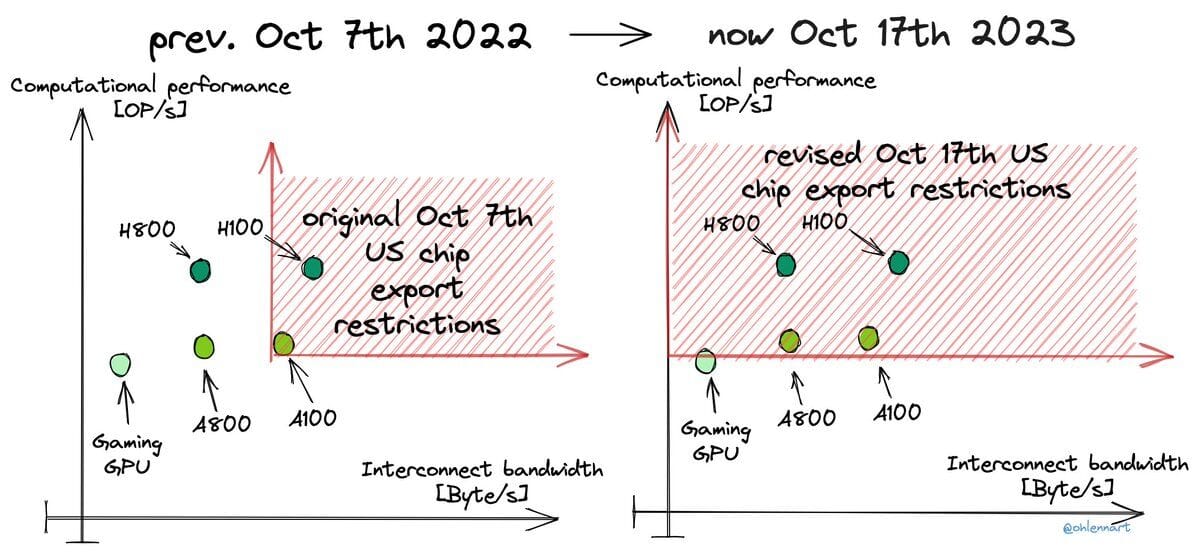

But Biden took it a step further. Not a tariff per se, but extremely consequential to the current state of AI affairs. In 2022, the Department of Commerce (Bureau of Industry and Security) imposed export controls on advanced AI chips, equipment, and software.

Among other measures, they placed an export ban on companies like Nvidia or AMD from selling top-end AI GPUs (A100, H100) to Chinese entities.

As you can see above, these export controls have become more hawkish over time. Currently, the only GPUs NVIDIA can sell to China are the H20, which were automatically purchased in full by Chinese companies for a value of $17 billion (although they are based on escalation of tensions).

Didn’t DeepSeek claim we were overspending on GPUs? Maybe, just maybe, that claim was false and markets overreacted in February? But I digress.

Importantly, this ban has since gone beyond US companies and has also targeted other companies in the semiconductor supply chain, like the Netherlands’ ASML or Taiwan’s TSMC, both extremely crucial chokepoints of the overall chip supply chain (the reasons will make sense later).

ASML is the sole producer of Extreme Ultraviolet (EUV) lithography necessary for high-end chips.

TSMC is the sole producer of sub-5 nanometer processing chips with good yields (other companies, both American (Intel), South Korean (Samsung), and Chinese (SMIC) have sub-5nm capabilities but with terrible yields, meaning most chips come out faulty).

In plain English, both are the only companies that tailor to advanced AI chips in their respective areas, period.

This has basically halted Chinese progress at leading-edge process nodes (7nm and below). Hold this thought for later.

Furthermore, in May 2024, Biden announced an expansion of tariffs on a wide range of Chinese-made goods, building on Trump-era Section 301 tariffs. The new set of tariffs explicitly targeted China’s capacity to challenge the US in critical sectors such as semiconductors, electric vehicles (EVs), solar panels, and medical equipment.

Additionally, new tariffs were introduced on critical sectors with direct implications for AI:

Semiconductors: Tariffs increased on chip dies, and scrutiny expanded to include downstream elements such as server racks and networking equipment.

Data center components: Racks, routers, switches, cooling systems, and some power management units were subject to new levies.

Rare earths and raw materials for chipmaking also received attention, although many components were already under export control.

As Katherine Tai, the US Trade Representative, stated during the May 2024 announcement: "Our tariff policy now reflects a clear vision: to preserve America’s leadership in the technologies of the future and deny strategic rivals the tools they need to challenge that leadership."

China, for its part, responded with retaliatory tariffs and export controls of its own. In particular, it limited exports of gallium and germanium (key inputs for high-end chips and sensors) and applied tariffs to American-made software and cloud services, making it harder for US tech firms to operate inside China.

All this takes us to April 2025.

A Trade Deficit, a Matter of National Emergency

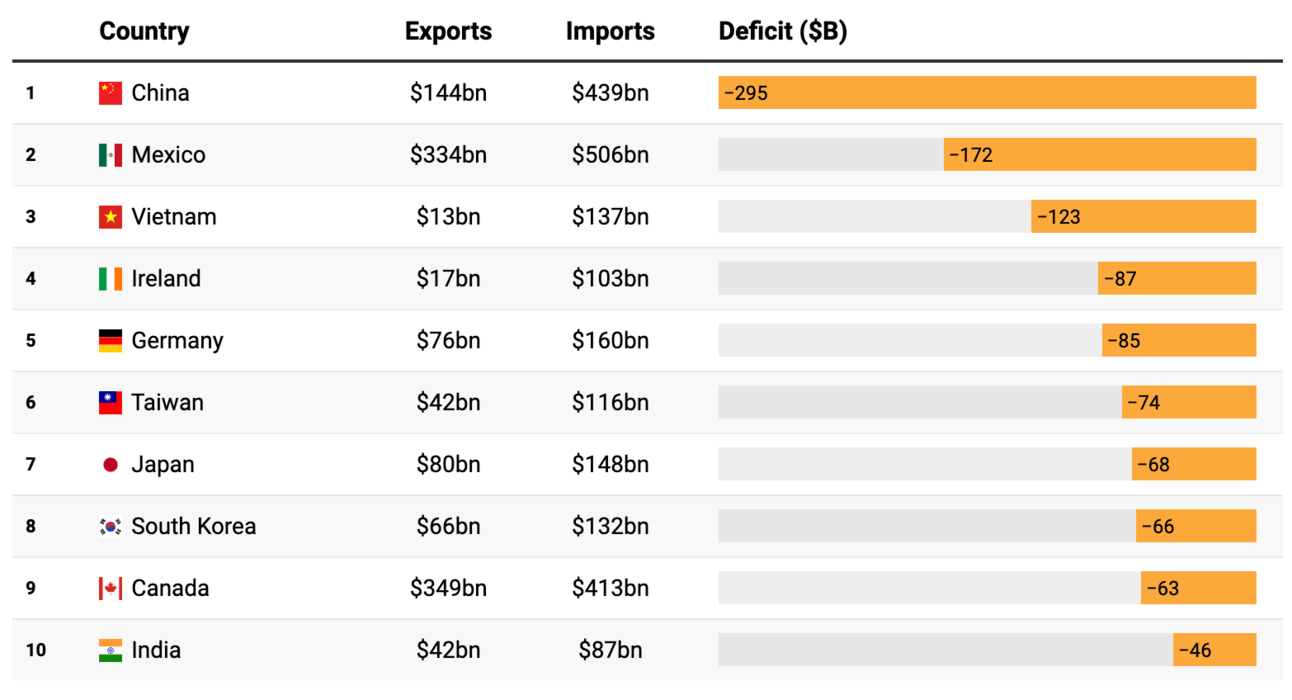

In 2025, the US-China tariff conflict has evolved into a crusade against the growing trade deficits the US has with multiple countries, declaring these deficits a matter of national emergency.

It must be said that the state of the current US economy is unsustainable; the government currently spends more on servicing its debt than its defense budget. In layman’s terms, the US Gov. spends more on interest payments than on Defense (projected to be $100 billion larger actually), taking this number close to a trillion dollars yearly.

Reducing this overall trade deficit is one way to fight this, but not necessarily the best one.

Let’s take a look at the recent timelines:

February 1, 2025: The Trump administration reimposed a baseline 10% tariff on all Chinese imports, framed as a first step in “correcting unfair trade.”

March 4, 2025: Tariffs were raised to 20% across the board, with Chinese retaliatory measures targeting US agricultural exports.

April 2, 2025 – ‘Liberation Day’ Tariffs Announced – In a nationally televised speech, Donald Trump declared a new 34% tariff on all Chinese imports. This brought the effective cumulative rate to 54%, a big jump compared to prior tariff rounds. The decision was framed as a “defensive measure to preserve American industry.” These “reciprocal” tariffs (‘reciprocal’ is doing a lot of work here) were expanded to dozens of other countries.

"We will no longer be the piggy bank that funds China's rise. The tariffs are the wall between our future and their unfair advantage,".

April 4, 2025 – China responded with symmetrical tariffs of 34% on all US imports, effective April 10. In addition, it expanded the aforementioned export controls on gallium, germanium, and several rare earth minerals crucial to semiconductor and battery production.

And what are the repercussions across countries?

The Bad, the Ugly, & The Horrific

The impact these decisions have made is tremendous and can be summarized in the table below (this is focused on AI):

Country/Region | Tariff Rate | Notes |

|---|---|---|

Global (most countries) | 10% (baseline) | Flat tariff on all imports to the US. Extensive product exemptions. |

China (total) | ~54% (20% + 34%) | Already had 20% tariffs early 2025; plus 34% “reciprocal” tariff in April. |

European Union | 20% | EU exports face a 20% US tariff. |

South Korea | 25% | This country plays an important role in memory chips. |

Vietnam | 46% | Vietnam is another key country in the AI supply chain. |

Key Exempt Products | 0% | Several products are tariff-free, but to AI, the key one is semiconductor chips. However, things aren’t as pretty as they look for the semiconductor industry, as we’ll see later. |

Based on this table alone, some companies are in deep trouble. For instance, as 90% of Apple’s manufacturing is based in China, Rosenblatt Securities expects a $39.5 billion expense increase if it decides to absorb the costs (instead of raising prices or moving out of China). That would represent 32% of its current operating profits, a catastrophe.

Naturally, AI will suffer severe repercussions from all of this. But to understand them fully, let’s summarize the close relationship between AI and semiconductors, which is the key link in the tariff discussion.

Why Semiconductors Matter and the Fragility of the Global Supply Chain

Artificial intelligence is totally dependent on semiconductors. Training large language models (LLMs) such as Gemini or GPT-4.5 requires thousands of highly advanced chips, mainly GPUs or AI-specific accelerators.

For companies like OpenAI to have a cluster of GPUs ready for training, the following steps are needed:

Once the US fabless companies design the chip, they send the designs to the fabs that manufacture the chips, which also need to source the required materials. These fabs, with an average cost of $20 billion, require costly manufacturing equipment.

Once the chips are manufactured, they are packaged into the boards to connect to other chips (memory, CPU, etc.). This whole package has to be tested, and the ones that aren’t broken are either delivered this way or mounted into the servers, enormous racks where the chips reside, before delivery.

These racks are located in data centers, requiring many other crucial data center equipment, such as cooling, power consumption, networking gear, etc.

The issue? This is a hyperspecialized and dislocated supply chain, with most companies focusing exclusively on a single piece of the puzzle. No single company on this planet has the entire supply chain verticalized; worse, no country either, and a manifold of countries have become chokepoints in crucial parts of the chain.

For example:

Minerals needed for this production are mainly sourced from China (up to 70% of the global market share).

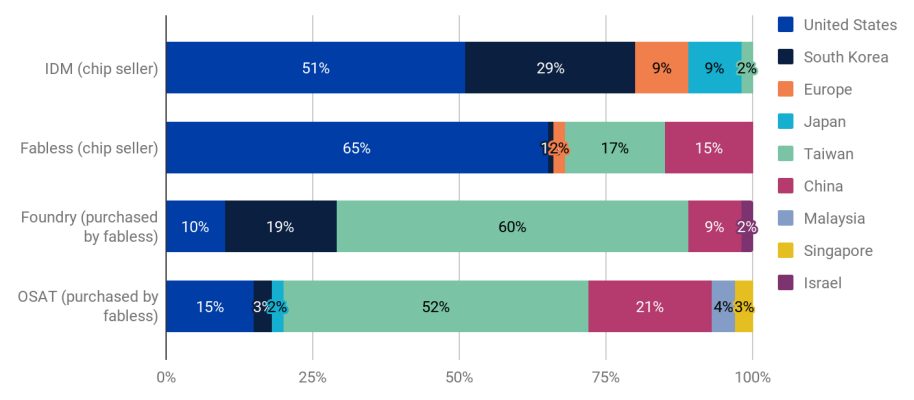

Chip design (IP): Mostly done in the US (Nvidia, AMD, Google, etc.).

Memory: Provided by Samsung, SK Hynix (South Korea), and Micron (US).

Lithography and equipment: ASML (Netherlands), Tokyo Electron (Japan), Applied Materials (US).

Chip fabrication is outsourced to TSMC (Taiwan), Samsung (South Korea), and, to a lesser extent, Intel (US). This means that US companies are mainly fabless (they design, not produce), while companies in Taiwan or Samsung are ‘fabs’, aka manufacturers (there are exceptions like Samsung, which does both).

EDA software: Controlled by Synopsys, Cadence, and Siemens (US and Germany).

Advanced packaging: Performed mainly in China for legacy chips, but solely in Taiwan for advanced chips (the particular case of AI).

Packaging testing: Mainly done in China and Taiwan.

This creates a sharply dislocated supply chain, which sounds good when considering the current tariff war, right?

Source. Not 2025 numbers, but the proportions have remained consistent.

But let’s add some further clarity to the numbers, considering Trump’s tariffs are country-targeted.

The AI Battleground

First of all, beyond the reciprocal tariffs China has just reinstated, China will probably engage in three additional measures:

Devaluation of the Yuan, to make Chinese exports more attractive even with the additional tariff costs.

Export controls on rare earths. As mentioned above, China is by far the largest supplier of rare earths, accounting for almost 70% of the total in 2024. This might lead to a supply shock of chips and an overall cost increase.

After last week’s state council, China openly stated that it would consider ignoring IP laws, a euphemism for engaging in espionage and stealing secrets to develop technology and compete (this was already highlighted as a threat back in February).

While the first might alleviate the pains for US companies (they can buy more with less), the second and third are particularly problematic.

So, how does all this affect the prominent companies in the AI industry? Which company/ies are the ugly ducklings in all this?

Besides answering this, and perhaps more importantly, we are going to understand why these tariffs are a once-in-several-decades event and why AI (and crypto stablecoins, wait, what?) are the crucial pieces in the tariff puzzle.

Hardware Companies

Affected players: NVIDIA, AMD, Broadcom, Qualcomm, TSMC, Huawei, SMIC, Groq, Micron, Hynix, Samsung, Intel, & SuperMicro, among others.

With regard to hardware companies, raising prices when their customers are probably thinking a lot about cutting capital expenditures is probably out of the question.

Moreover, they enjoy hefty gross margins (especially NVIDIA, above 70%, with other players like SK Henix or AMD in the 50% range), so they will probably absorb the costs—at least partially—of limited access due to supply shocks in rare earths and, of course, tariffs.

Focusing on GPU providers, it’s important to note that most NVIDIA/AMD supply contracts have likely been in place for several months (in the words of Jensen Huang), so the effects will probably be felt later. However, investors won't welcome a massive impact on gross margins, as they already showed concerns in NVIDIA’s last earnings call.

An important point to mention about NVIDIA is that their accounts receivable, the amount of money they are owed by clients on GPUs that have already been delivered, is rising to concerning values (+32%) even before the tariffs appeared into the equation.

Overall, the main issue for these companies is the future is fueled with uncertainty.

But why do I say this? Aren’t semiconductors exempt from tariffs? The reason for this is that, ironically, we really don’t know how tariffs will impact, because the complexities of the entire picture go much deeper than what most people, including those making the decisions in the Trump Administration, actually realize.

Subscribe to Full Premium package to read the rest.

Become a paying subscriber of Full Premium package to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- NO ADS

- An additional insights email on Tuesdays

- Gain access to TheWhiteBox's knowledge base to access four times more content than the free version on markets, cutting-edge research, company deep dives, AI engineering tips, & more